News

Stay connected with Harvard Chan School

The latest public health news delivered right to your inbox.

Featured Stories

Class of 2025

From Our Students

All News

Rise in antibiotic-resistant gonorrhea may be due to wide use of doxycycline for other STIs

Gonorrhea bacteria are becoming more resistant to the antibiotic doxycycline, potentially because the drug is taken after unprotected sex to preemptively lower the chance of contracting other sexually transmitted infections, according to a study.

Vaginal probiotics may not provide purported health benefits

Although vaginal probiotic products are marketed to promote vaginal health and treat infection, current scientific evidence does not necessarily support these claims, according to experts.

Will RFK Jr. really curb ultra-processed foods, like he promised? Experts weigh in.

HHS Secretary Robert F. Kennedy Jr. has targeted ultra-processed foods, saying they’re a major contributor to chronic disease in the U.S. Some food experts welcome his stance, others are skeptical if food policy changes will come to fruition.

Limited access to healthy foods may raise childhood asthma risk

Living in neighborhoods with limited access to grocery stores—and thus nutritious foods—can increase children’s risk of asthma, according to a study.

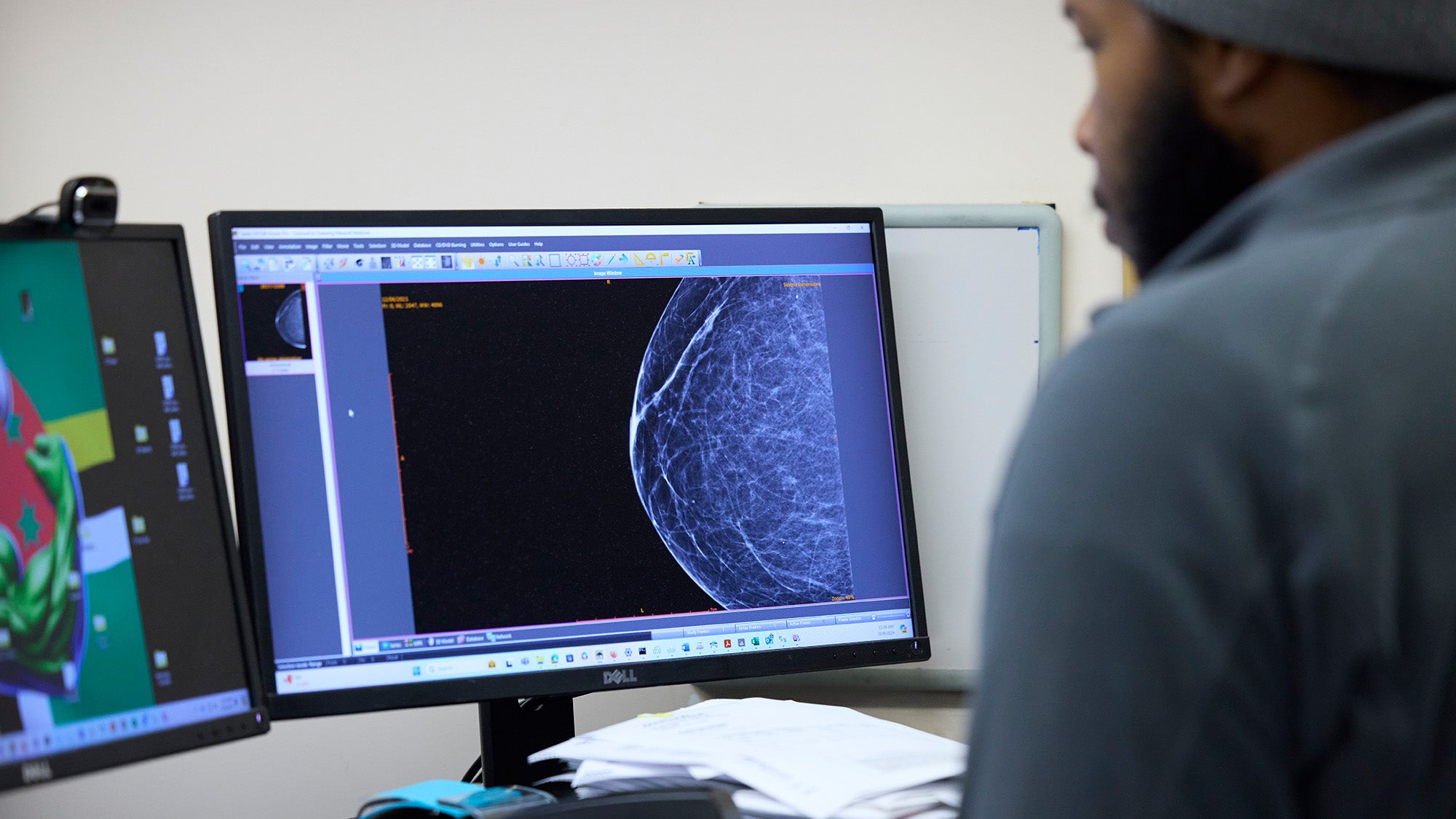

Women speak out on risk to landmark Nurses’ Health Study

Nurses’ Health Study participants spoke out against its federal funding termination.

Adolescents’ use of mental health services unequal across racial groups

Adolescents belonging to racial minority groups are significantly less likely to receive mental health care than white adolescents, according to a new Harvard Chan School study.

Helping children eat healthier foods

Harvard Chan School’s Erica Kenney discusses how federal grant terminations may impact her research on how to help families, particularly children, eat nutritious foods.

Trump megabill preventing artificial intelligence regulation could harm planet’s climate

U.S. Republicans in Congress are currently working to pass a tax and spending bill that may include a provision banning states from regulating artificial intelligence—a move that could increase the technology’s electricity consumption and worsen climate change, according to experts.

Extreme heat worsens air pollution health risks

Rising temperatures due to climate change are exacerbating the health risks of air pollution, experts say.

Ticks on the rise: Strategies for preventing disease

Fueled by warming temperatures and wetter climates, tick-borne illnesses such as Lyme disease and babesiosis are becoming more prevalent across the U.S. In this panel discussion, researchers and clinicians discussed…